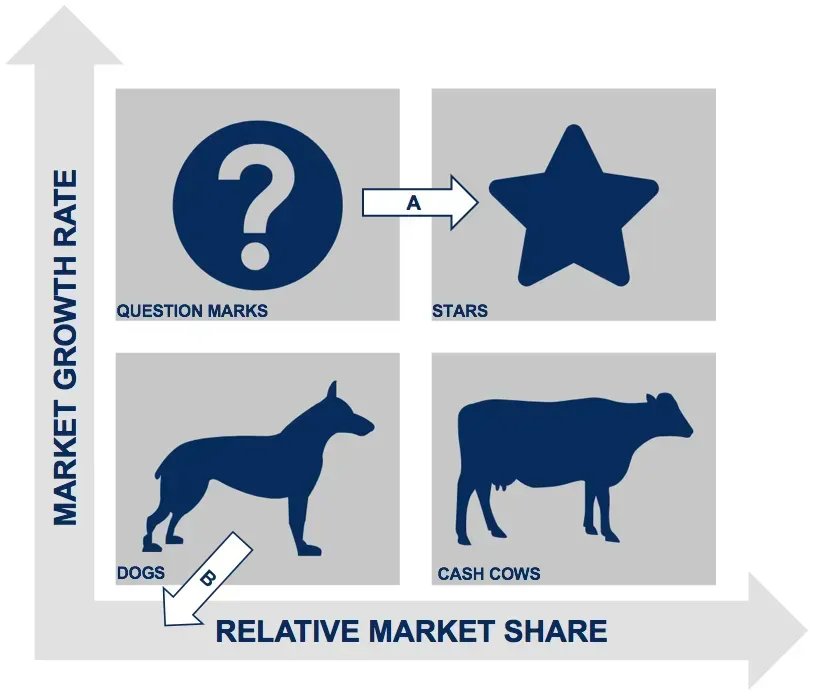

The Boston Consulting Group matrix (BCG matrix), also known as the product portfolio matrix, is a business planning tool used to evaluate the strategic position of a company's brand or product portfolio. The BCG matrix is one of the most widely used methods for analyzing the composition of business assets. It classifies a company's brands, products, and/or services into a matrix along two axes that form 4 quadrants. Each quadrant is classified as low or high performance, based on relative market share and market growth rate.

Understanding the Boston Consulting Group (BCG) Matrix

The horizontal axis of the BCG matrix represents a product's market share and its strength in a given market. By using relative market share, it helps measure a company's competitiveness.

The vertical axis of the BCG matrix represents a product's growth rate and its growth potential in a given market.

From this, the four quadrants are derived:

- Question Marks: Products with high market growth but low market share.

- Stars: Products with high market growth and high market share.

- Dogs: Products with low market growth and low market share.

- Cash Cows: Products with low market growth but high market share.

A closer look at the quadrants

The matrix is based on the assumption that an increase in relative market share translates into an increase in cash flow. A company benefits from economies of scale and gains a cost advantage over competitors. Market growth rates vary from industry to industry, but typically use a 10% threshold: growth rates above 10% are considered high, while those below 10% are considered low.

Question Marks

Products in the question marks quadrant are in a rapidly growing market, but the product or products have a low market share. Question marks are the most challenging products to manage and require substantial investment and resources to increase their market share. Investments in question marks are typically funded by cash flows from the cash cows quadrant.

In the best-case scenario, a company would want to turn question marks into stars (as we will see). If question marks fail to become market leaders, they end up becoming dogs when market growth declines.

Products in the dogs quadrant are in a slow-growing market where products have a low market share. Products in the dogs quadrant are generally able to sustain themselves and provide cash flows, but will never reach the stars quadrant. Companies typically phase out products in the dogs quadrant for obvious efficiency reasons, unless they are complementary to existing products or are used for a competitive purpose.

Products in the stars quadrant are in a rapidly growing market where the product or products have a high market share. Products in the stars quadrant are market leaders and require significant investment to maintain their position (for example, in marketing), drive growth, and maintain a competitive advantage.

Stars consume a significant amount of cash but also generate large cash flows. As the market matures and products continue to succeed, stars transform into cash cows. Stars are a company's most valuable asset and are the focus of attention in its product portfolio.

Cash Cows

Products in the cash cows quadrant are in a slow-growing market but the product or products have a high market share. Brands, products, and services in the cash cows quadrant are considered market-leading products that should be valued but without excessive effort.

Quite literally: as long as they work and as long as they last, you milk them.

What are the benefits of the BCG matrix?

In a business context, the BCG matrix is a simple yet incredibly effective tool for evaluating a company's product portfolio. The matrix provides a broad overview of each product's performance and helps identify the factors driving its success or failure. Furthermore, the matrix can be used to see how different products compare against each other in an essential systemic approach.

Moreover, the BCG matrix is a valuable resource for companies looking to improve their products or identify new opportunities in their market. This is one of the most sensitive and challenging tasks that an entrepreneur or manager must face.

By shedding light on weak products, the matrix can help companies save money in the long run. In other words, it is a valuable tool that no company should do without.

What are its limitations?

The BCG matrix is a great way to get a snapshot of how your products are performing in the market, but it does not tell the whole story.

There are other factors to consider when talking about a product's success or failure, such as customer satisfaction, product quality, and company reputation. Not to mention brand equity in the broader sense. The BCG matrix is a good starting point, but it cannot account for everything. To make the most informed decisions about your products, you need to look at all available data.

There are many other problematic aspects to this approach:

- Market growth is only one of many factors that determine industry attractiveness. Relative market share is only one of many factors that determine competitive advantage. This matrix does not account for other factors that may affect industry attractiveness and competitive advantage.

- The underlying assumption is that business units operate in isolation from one another. In reality, a dog can help another unit gain a competitive advantage in terms of cash flows and sales correlation.

- The definition of market is taken in a broad sense. This does not account for different situations, such as a business unit that dominates a niche but is overall less dominant in the broader industry. How a market is defined in this case can change its classification from dog to cash cow.

How to properly use the BCG Matrix in strategy?

The BCG matrix is therefore a tool that helps you evaluate your products objectively to define a strategy for your company's future. It helps you identify which products to focus on and which ones you may need to cut entirely. It can be used in four ways to guide a business strategy.

- If your goal is to focus on innovation, increase investments in Stars and Question Marks. For example, investing more in a question mark can transform it into a star and, subsequently, into a cash cow.

- If you cannot invest more in a product, keep it in the same quadrant and leave it alone. One of the advantages of a Cash Cow is, for example, that it is an established product that requires less effort to maintain.

- By reducing investment and extracting maximum cash flow from a product, you increase its overall profitability.

- If resources need to be better allocated, you can divest the amount of money invested in a product and use it elsewhere. This strategy is best suited for dogs.

An important example

When discussing BCG analysis, it can be useful to look at real-world examples. A famous case is that of The Coca-Cola Company. This company owns numerous beverage lines, including the Coca-Cola brand, Diet Coke, and Minute Maid.

In terms of the BCG matrix, Diet Coke and Minute Maid are question marks. These products have a modest following but still have room to grow. Meanwhile, the bottled water brands Kinley and Dasani are considered Stars due to their dominant market shares in the United States, with no signs of slowing growth. Finally, Coca-Cola itself is a Cash Cow, as it operates in a low-growth segment but with a high market share. However, the company also has dogs because legislation against soft drinks -- not to mention adverse public sentiment -- has caused sales to decline for some of its soda brands.